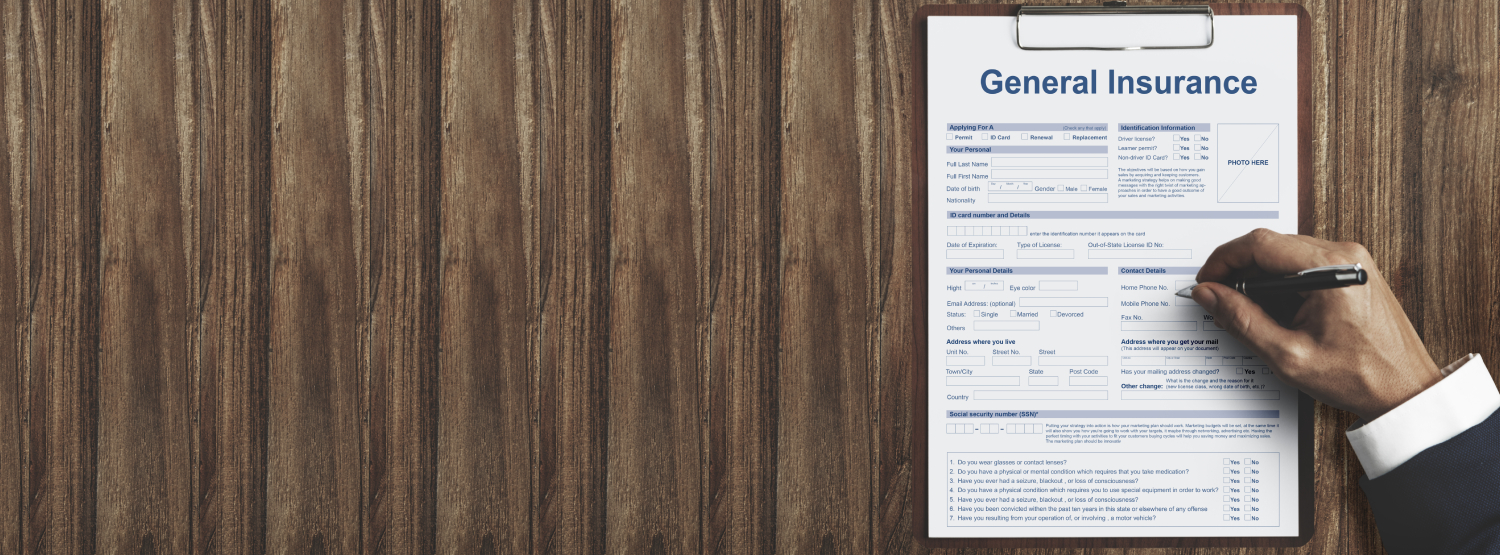

The Next-Gen Insurance Experience with General Insurance Software Solution

Ready to switch from your preexisting standalone system? We offer AmityAssure, a core general insurance software solution. The system’s modular structure facilitates the expansion of its limited processes with scalable components such as underwriting, policy, claims, finance, reinsurance, etc. Our core insurance system is enhanced with a user-friendly web portal for front-office operations. Moreover, it enables the integration of third-party data sources, such as CRM systems, datasets, and APIs.

Our General Insurance Software System is designed to meet the software needs of insurance enterprises. AmityAssure supports a range of insurance products, including home, motor, travel, commercial, and other types. Whether it is non-life, property, or casualty insurance, the solution serves all.

AmityAssure reduces the time-to-market, improves accuracy, and delivers a consistent, cross-channel customer experience across general insurance coverage areas.

Core Modules of General Insurance Software

Key Advantages of a Robust General Insurance Software

Manual monitoring and working of the general insurance business lead to data redundancy, maintenance of a pile of documents and files, time in generating reports after studying all the concerned documents, time taken to search for any information and many more. To curb all these challenges, you can opt for AmityAssure a computerized system that manages everything for you.

A Complete Process of Implement General Insurance Software Solution

Requirement Analysis

Design

Implementation